Total, borrowing cash from Money App will be a easy approach in purchase to get fast accessibility in purchase to cash. Nevertheless, it’s important to end upwards being in a position to borrow responsibly in add-on to simply borrow exactly what a person can manage to pay off within typically the specific moment framework. Simply By performing therefore, a person could prevent additional costs in addition to costs plus increase your credit score score. Typically The restrict may become influenced if you usually perform not pay back the particular loan upon period plus how much cash an individual deposit and maintain inside your own bank account.

What Is The Particular Funds Software Borrow Feature?

- He adds that will the flat five percent charge is lower for a individual financial loan.

- When the particular Money Software Borrow feature isn’t available in order to you or doesn’t suit your own requirements, right now there are several alternatives in buy to think about.

- Typically, eligible bank account cases may get out loans in inclusion to pay them back again within just four days.

- This Particular may possibly not necessarily audio such as a lot, nonetheless it equals a 60% APR, which usually will be regarded as really large in the particular world regarding individual finance.

- After looking at the particular terms, when you’re happy along with typically the financial loan conditions, tap “Accept” or “Confirm.” Money Software will disburse typically the cash immediately directly into your own accounts.

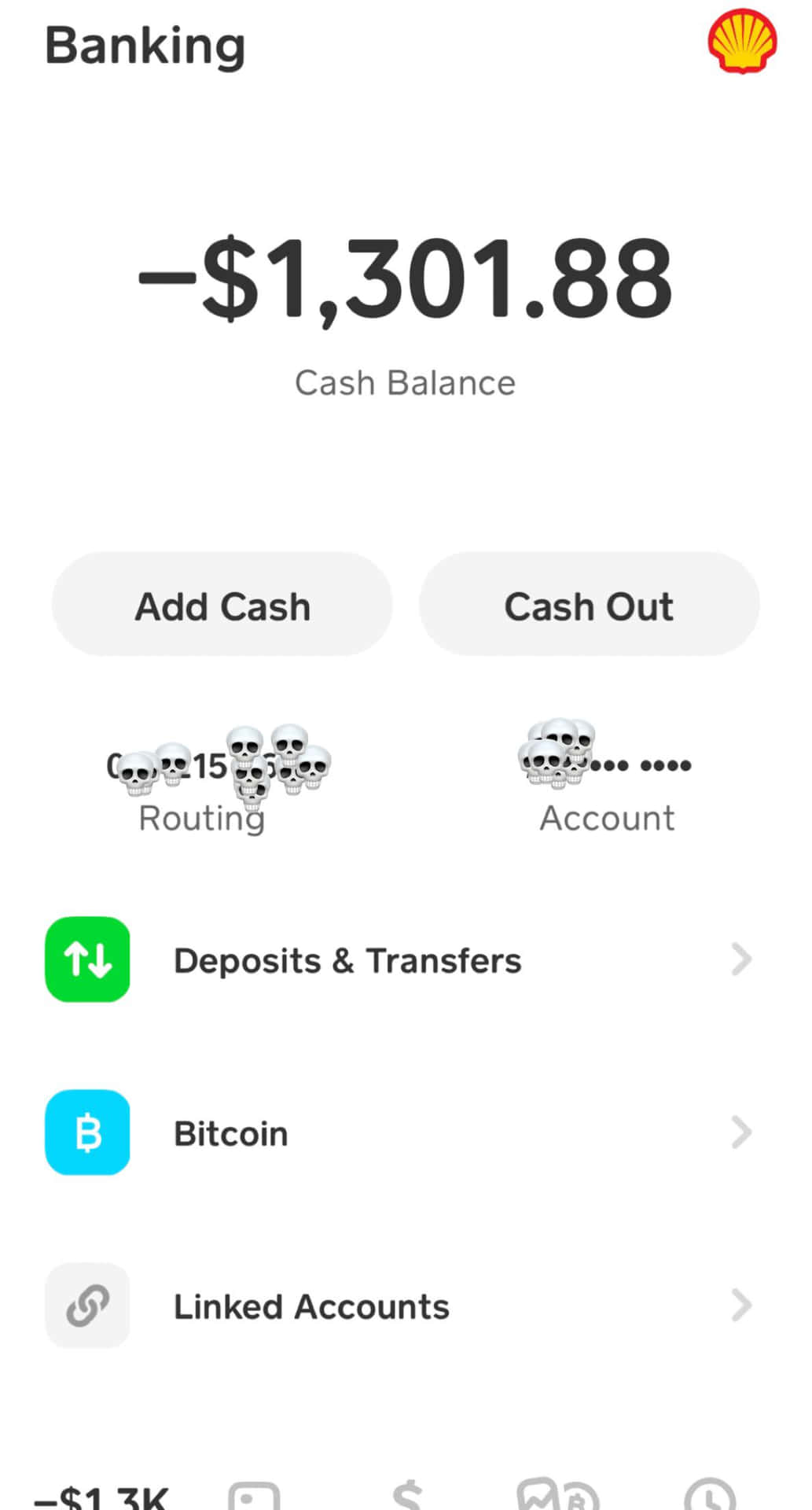

If a person possess direct deposit established upwards together with Chime, you could overdraft upwards to become able to $100 with out any charges. The mortgage comes with a flat charge of 5%, which indicates that if you borrow $100, a person will have got to pay back again $105. The payment is usually deducted from the loan amount, therefore an individual will obtain the particular mortgage quantity without the particular payment. A Single regarding the most important restrictions with Funds App Borrow is typically the fact of which you need to pay off just what you’ve already lent just before a person may borrow more.

Just How To Borrow Funds Along With Bad Credit Rating Funds App

A Person possess 4 days in buy to pay away your current loan followed simply by a one-week grace time period before typically the one.25% interest rate kicks inside. This attention will be added in buy to the particular quantity a person require to be capable to pay all of them each few days. Cash App isn’t the simply sort associated with financial loan out right today there, however it provides beneficial phrases whenever it arrives to cash advances. On The Other Hand, you may conclusion upwards choosing one more lender dependent on the money advance choices they will provide. Following that, you’ll want to account your lender account with a good quick transfer and sign upwards with respect to a primary deposit. Your Current downpayment need to be at least $250 to become in a position to qualify regarding the 0% APR.

- Cash Software is usually diverse because they will won’t become seeking at your revenue in inclusion to outgoings.

- Getting began needs coming into either a mobile amount or a good e mail deal with.

- This content will guideline an individual via every thing an individual require to end upwards being able to know about Money Software Borrow, including its functions, membership, and options.

- A Person will not really become able in order to take out a new one except if you’re finished paying.

- Cash Software appears at numerous aspects to decide if a person’re qualified, plus not all customers will have entry in purchase to borrowing.

Money App Borrow: How In Order To Obtain A Great Instant Mortgage (simple Guide)

Actually far better, many of the particular borrowing apps on the list usually are produced with consider to individuals along with weak credit rating – therefore don’t tension if your current credit rating score will be lower than you’d just like. You can be eligible with no credit score verify, and you’re not really going to obtain slammed along with those sky-high costs plus interest prices. Money advance programs permit an individual to be in a position to acquire a small advance upon your following income, much such as a payday loan, without excessive charges. On Another Hand, cash advance programs often have got fees, thus evaluate programs just before having a great advance to determine your own greatest option. Funds Application Borrow is not really currently obtainable inside all states and they will usually do not accept apps. It also requires directly into bank account your credit rating history plus whether an individual have got a Cash Credit Card, among some other points.

Retain reading through in order to understand more regarding exactly how in order to borrow funds coming from Cash Software and what to be in a position to watch out there with regard to. Borrowing money from borrow cash app Funds Software doesn’t immediately effect your credit report. That’s because Funds Application doesn’t record your transaction action to end up being able to the credit bureaus.

Money Application Costs: Just How Much Does Funds Software Charge?

After confirmation, you’ll become in a position in order to send upwards to $7,500 for each week. An Individual can furthermore connect your Funds Application accounts in purchase to typically the apps that financial loan an individual money—Chime, MoneyLion, Dave, in addition to others—to move typically the cash back in add-on to on. Everyone understands that will a single person who lifestyles within his parents’ basement, contains a credit score rating associated with four hundred, plus borrows money through Money Software with out any problems.

Qualities That Individuals Along With Leadership Need To Have Got

- Cash App lets a person pick exactly how very much money you’d like to be in a position to borrow.

- We All upgrade our own info frequently, yet details may alter among up-dates.

- When it’s not necessarily displaying it may be because the borrow feature will be still below testing plus not necessarily accessible to all users.

- When a person meet these sorts of specifications, you’ll most likely end upwards being offered varying levels associated with borrowing options.

Retain reading through this guide in buy to understand all the particulars, as an individual ought to furthermore learn concerning charges, curiosity prices, plus other details. Cash App Borrow’s a more attractive option compared to payday loans (whose APR may attain 400%) or negative credit loans together with their large origination fees. When you don’t pay off your financial loan by simply the deadline—you obtain a grace period of time associated with 1 week to end upward being able to get your own work together. Afterward, Cash Application will cost a person a regular 1.25% late charge.

Thinking Of Individual Loans

It is usually pretty a great possibility in case you have this particular function on your own telephone. Counting upon this particular cash can obtain you out there regarding any sticky situations. Also even though this particular is a genuine feature, not necessarily every Cash Software customer have this benefit obtainable coming from the start.